Of all items in the consumer price basket, the energy category used to be the easiest to forecast. Oil prices were pretty much all we needed to keep an eye on to forecast this volatile CPI component.

That was before gas supply disruptions and the Green Transition. European gas prices are now disconnected from the rest of the world energy prices, while carbon pricing rules exert specific influence on electricity production in Europe.

Throw in fuel duty changes and COVID related manufacturing production disruptions and energy prices in the main regions can get disconnected.

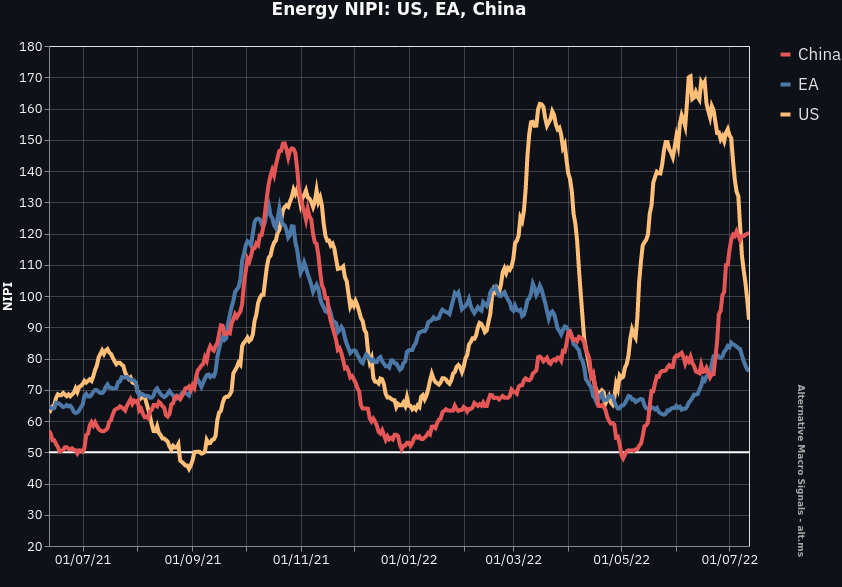

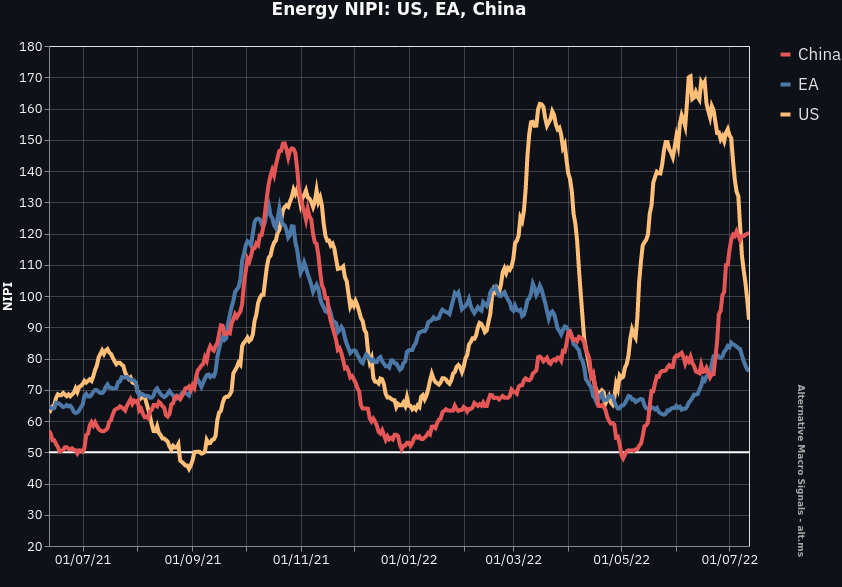

Our NIPI Energy series illustrate this, with a rapidly falling index in the US, a very slightly falling one in the Euro area and a decent rise in China:

Note: A value above 50 indicates positive price pressures; a drop in the index suggests a deceleration.

Read more:

Inquiries: reach out