Chinese inflation is somewhat puzzling at the moment:

with the Dec-21 CPI release at 1.5% year-on-year, Chinese inflation stands well below US and European rates, while China should be the epicenter of global supply chains disruptions.

Simple volatility artefact? Or are we excessively focused on supply chain disruptions?

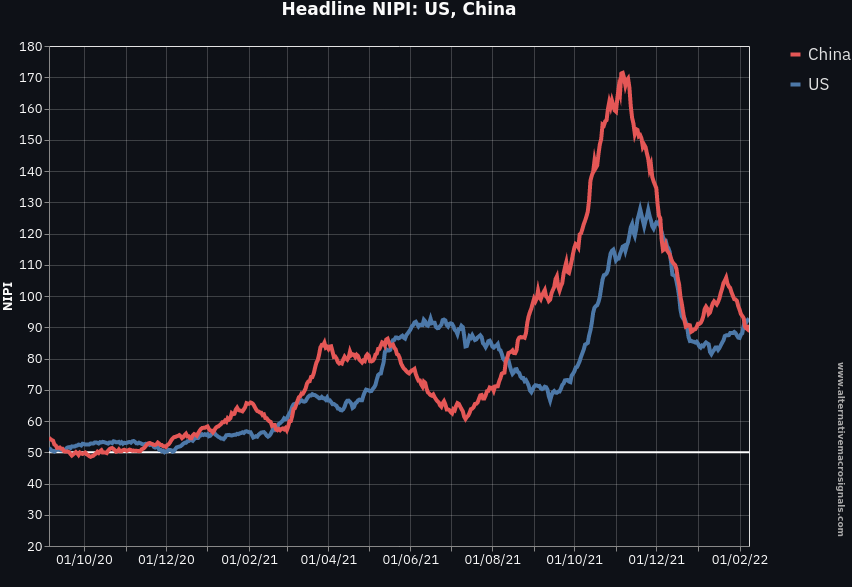

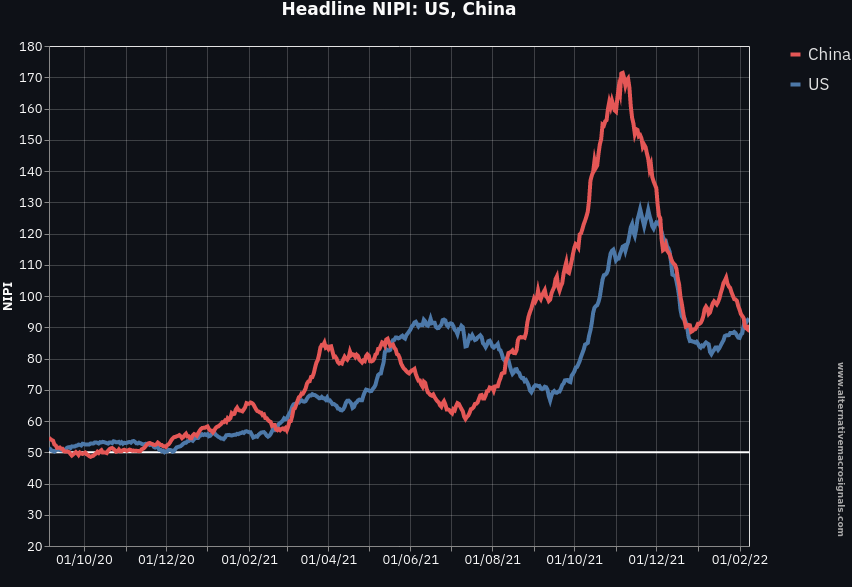

Our newly released News Inflation Pressure Index (NIPI) can help answer:

The NIPI shows retail price inflation pressures through local news articles. It reads like a PMI (50=neutral).

True, headline Chinese inflation pressures have eased from a peak reached at the beginning of December 2021.

But this needs to be nuanced by two observations:

- the level remains very strong indeed, very much off normal range and comparable with US ones - remember 50 means neutral inflationary pressures

- the observation holds for core inflation as well (excluding the direct effect from food and energy prices which have eased in recent weeks in China):

Overall, the China NIPI shows much stronger underlying inflation pressures than the CPI reports.

Unsurprisingly perhaps, inflation remains "largely a global phenomenon"*. And the current shock is certainly no exception.

Read more about the new China NIPI and the NIPI in general.

For any inquiries, including trial request, please use ourcontact form.

* A global inflation component is often found to explain most inflation volatility across countries, see Ciccarelli, M. and Mojon, B.,Global inflation, ECB Working Paper 537, October 2005.